The Corporate Transparency Act may require certain U.S. companies to disclose beneficial ownership information to FinCEN to combat financial crimes.

While a Texas federal district court’s preliminary injunction puts this requirement on hold, many experts expect that to be overturned. In that event, failure to file could lead to fines of $500 per day, up to a maximum of $10,000, and possible criminal penalties.

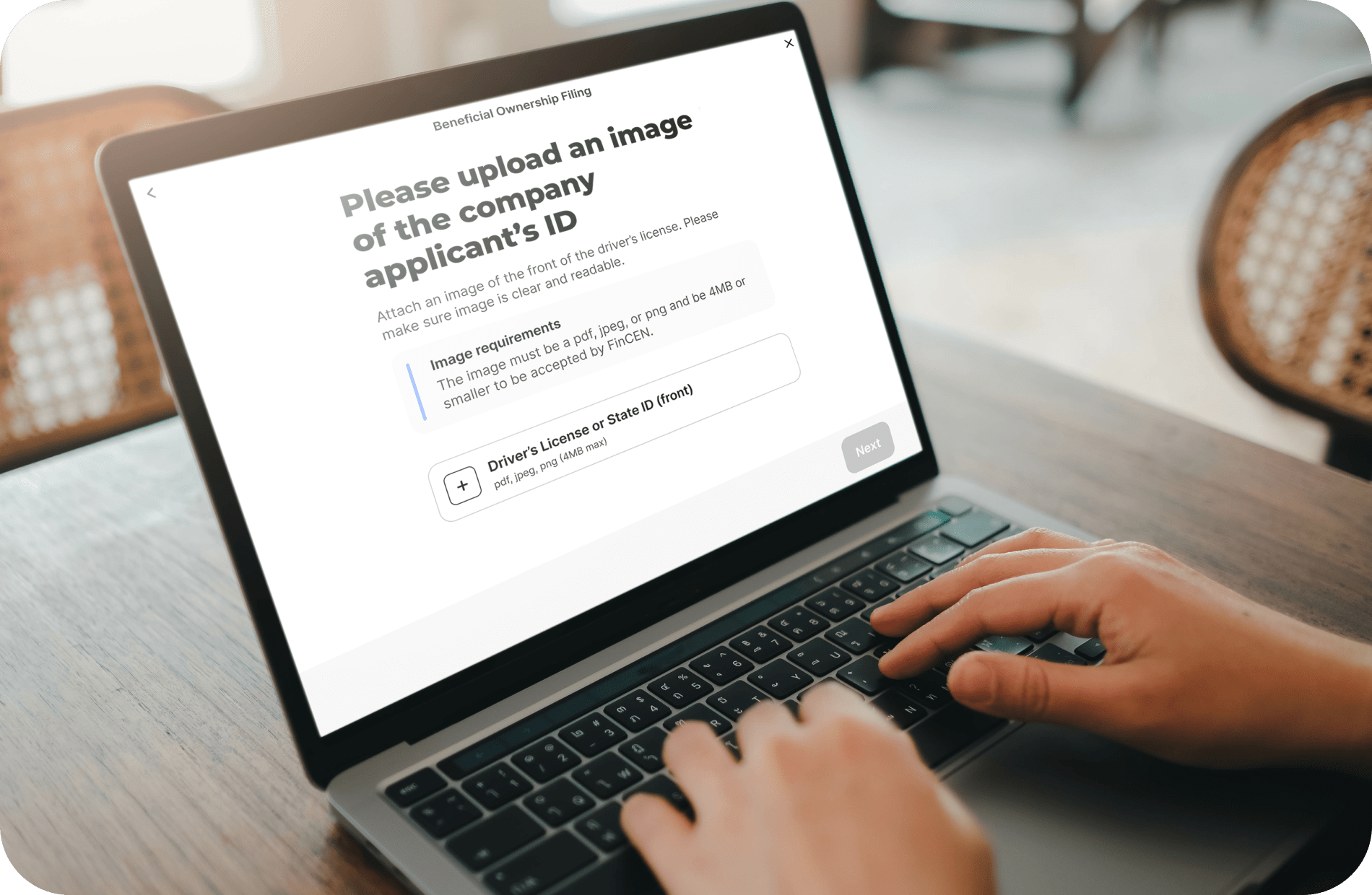

However, filing your Beneficial Ownership Information (BOI) report will help you avoid fines if this injunction is overruled. Waiting could mean scrambling to meet compliance requirements or penalties. ZenBusiness facilitates BOI reporting for your business with simple instructions and comprehensive yet painless processes. This is ideal for SBOs that want to avoid trouble by cleaning up their obligations in advance.

1. Determine if Your Business Must File.

A ‘reporting company’ is any small business, corporation, or LLC that is registered with the state, unless exempt. Exemptions apply to publicly traded companies, banks, and charities. For example, a local coffee shop in St. Joseph, MI would likely need to file a BOI report.

2. Identify Your Beneficial Owners.

A ‘beneficial owner’ is someone who either has substantial control over a company or owns at least 25% of it. This can include decision-makers, managing partners, or co-owners with significant stakes. For example, a co-owner of a travel agency in St. Joseph who oversees operations and owns 40% of the business qualifies as a beneficial owner.

3. Gather the Required Information.

Prepare:

-

Business name, address, and EIN.

-

Beneficial owners’ names, addresses, DOBs, and ID details.

4. File Your BOI Report.

Deadlines:

-

Existing businesses: File by 01/01/2025.

-

New companies (2024): File within 90 days of formation.

-

New companies (2025+): File within 30 days of formation.

ZenBusiness provides SBOs with customized tools and targeted resources for meeting BOI guidelines now and avoiding penalties. This type of service makes reporting your company’s information quick and easy.

Additional Resources:

We want to hear from you!

Join us in making an impact! Complete our BOI survey by December 18, 2024, and for every 25 responses, our Chamber will receive a $100 donation. Take the survey here! Your participation is invaluable!

As of December 3, 2024, a Texas federal district court has issued a preliminary injunction for all states to block the CTA and its relevant regulations. However, filing your BOI will help you avoid fines if this injunction is overruled.